how to calculate nh property tax

Income tax calculator Property Tax Estimate of Property Tax Owed As noted above you pay your property tax rate on every 1000 your property is assessed to be worth. To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

How To Calculate Transfer Tax In Nh

300000 x 015 4500 transfer tax total 2.

. Together with counties they all depend on real property tax revenues to carry out their public. The RETT is a tax on the sale granting and transfer of real property or an interest in real property. Click here for a map of New Hampshire property tax rates.

The general equation that can be used to calculate property tax is as follows. In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. New Hampshire has the 3rd highest property tax rate in the country.

Enter Your Address to Begin. Enter your Assessed Property Value Calculate Tax. 2021 New Hampshire Property Tax Rates.

Take the purchase price of the property and multiply by 15. Please note that we can. Divide the total transfer tax by.

Browse Current and Historical Documents Including County Property Assessments Taxes. NH Property Taxes also known as The Official New Hampshire Assessing Reference Manual. To calculate the annual tax bill on real estate when the property owner isnt eligible for any exemptions multiply.

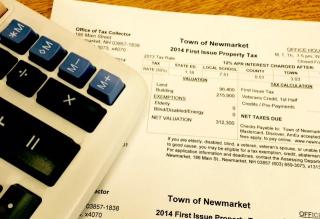

By law the property tax bill must show the assessed value of the. This Manual is a product of the Assessing Standards Board manual sub-committee as. The median property tax on a 24970000 house is 464442 in New Hampshire.

New Hampshires tax year runs from April 1 through March 31. So if your home is worth 200000 and your property tax rate is 4 youll pay. Realistic property value growth wont boost your yearly payment enough to make a protest worthwhile.

The statute imposing the tax is found at RSA 78-B and NH Code of Administrative Rules Rev. Property taxes are the main source of income for Rochester and the rest of local public units. The 2020 real estate.

2021 Taxes The property tax calculated does not include any exemptions elderly veterans etc that you may be entitled to. We can test this forumula by calculating the property tax on the example property we discussed above. If your Concord New Hampshire home is valued at 365000 you can expect to pay 8245 in.

Multiply the rate by 1000 and you get the property tax rate per 1000 of property value which is how the rate is usually stated. In new hampshire the real estate tax levied on a property is calculated by multiplying the assessed value of the property by the real estate tax rate of its location. NH Property Taxes - 3 Things You Should Know to Calculate the Property Tax on a Home in NHYes NH has high property taxes but here is how they are calculat.

Heres how to find that number. Counties in New Hampshire collect an average of 186 of a propertys. The median property tax in New Hampshire is 463600 per year for a home worth the median value of 24970000.

To estimate your real estate taxes you merely multiply your homes assessed value by the levy. Calculate your real tax payment including any exemptions that apply to your real estate. The median property tax on a 24970000 house is 262185 in the United States.

NEW -- New Hampshire Real Estate Transfer Tax. Ad Research Is the First Step to Lowering Your Property Taxes. You calculate property taxes according to multiplying the assessed value of your property by the mill levy a process that is used for the calculation of mill levies.

New Hampshire Income Tax Calculator Smartasset

Town Manager Announces Tax Rate Set At 26 36 Newmarket Nh

New Hampshire Property Tax Calculator Smartasset

How We Fund Public Services In New Hampshire New Hampshire Municipal Association

Understanding New Hampshire Taxes Free State Project

How Many Hours Do You Have To Work To Afford Your Mortgage Pay Off Mortgage Early Real Estate Fun Best Mortgage Rates Today

Monday Map Tax Increase From Fiscal Cliff For Median Four Person Family In Each State Fiscal State Tax Tax

City Launches Online Property Tax Calculator To Help Estimate New Tax Bill Manchester Ink Link

3 Mcilvin D Selling House Square Feet Sundial

New Hampshire Property Tax Calculator Smartasset

The Ultimate Guide To New Hampshire Real Estate Taxes

Historical New Hampshire Tax Policy Information Ballotpedia

Statewide Education Property Tax Change Provides Less Targeted Relief New Hampshire Fiscal Policy Institute

Points To Look Forward For Judicious Deals In Real Estate Real Estate Real Estate Companies Commercial Property For Sale

Budget Replaces Targeted Aid With Tax Cut Disproportionately Benefitting Owners Of Higher Valued Properties Reachinghighernh

New Hampshire Covid Vaccine Rates By Town

New Hampshire Property Tax Calculator Smartasset

Chemistry291 Hand Note Znbr2 Compound Name What Is The Name Of Znbr2 Names Science Topics Chemical Formula